Why AI Matters in BFSI

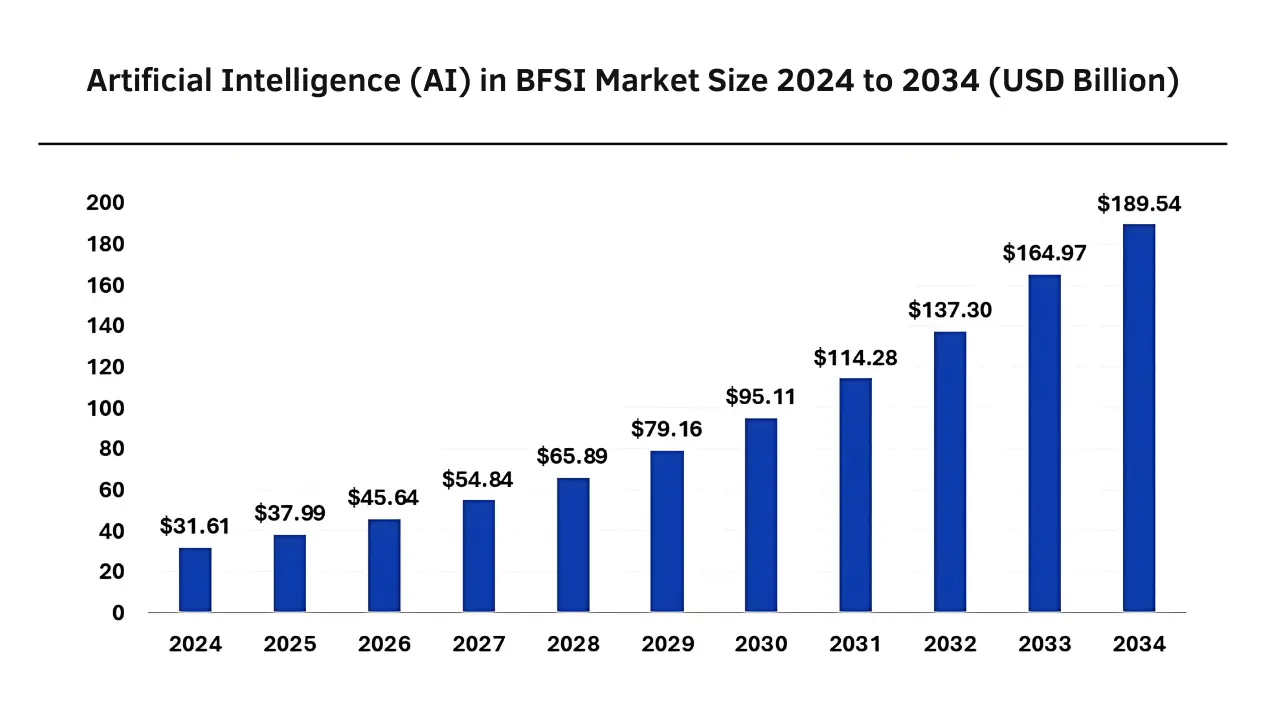

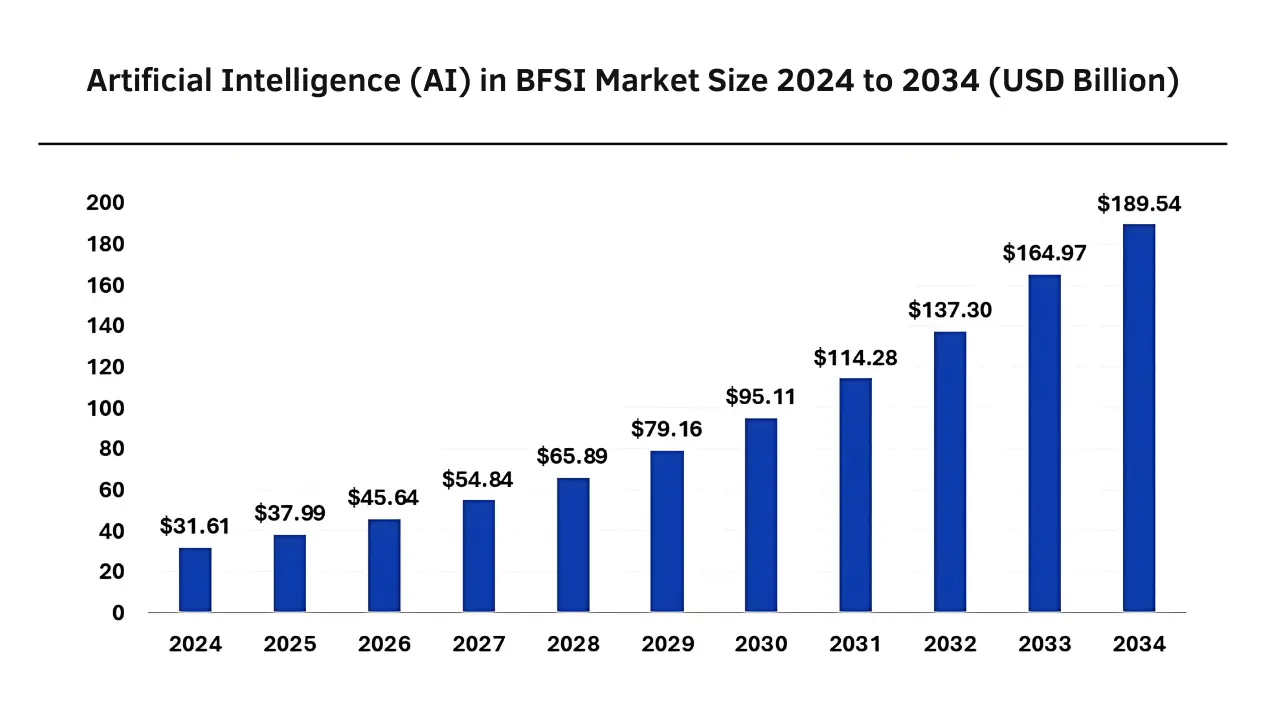

The Banking, Financial Services, and Insurance (BFSI) industry has always been a pillar of the global economy. The BFSI industry is undergoing a profound AI-powered transformation due to the rapid evolution of technology. AI is transforming everything fintech companies do, from the way they conduct business to the way they service customers and interact with them. According to Precedence Research, the global AI in BFSI market was valued at approximately USD 25.4 billion in 2024 and is projected to reach around USD 189.54 billion by 2034, reflecting a compound annual growth rate (CAGR) of 19.62% from 2025 to 2034.

Image Source: Precedence Research

Image Source: Precedence Research

According to research from the International Data Corporation, global investment in AI within the banking and financial services industry is expected to exceed USD 126 billion by 2028, highlighting the sector’s commitment to adopting AI technologies. With the capability to quickly process volumes of data, identify trends, and predict future events with higher accuracy rates than humans, this ranges from predictive analytics to make more informed decisions, chatbots to have personalized customer interactions, and sophisticated fraud detection algorithms.

An Overview of Industry Disruption by AI in Banking, Finance, and Insurance

AI solutions for BFSI have emerged as a core driver of ongoing transformation with the potential to bring creative new solutions to the opportunities and challenges that face the sector as it moves into the future, simplifying operations, lowering costs, and allowing smarter, data-driven decisions.

How AI is shaping different BFSI sectors:

1. Banking:

In banking, AI-powered banking transformation helps improve customer service with intelligent chatbots, streamlines back-office processes, and offers more personalized banking experiences using predictive analytics. AI is used for credit scoring, fraud detection, and loan origination. Banks are increasingly deploying AI-powered chatbots to handle customer inquiries, providing personalized and efficient support. For instance, Commonwealth Bank’s AI-driven messaging services manage approximately 50,000 daily interactions, improving customer satisfaction and reducing operational costs. A recent advancement includes the integration of voice-enabled banking, with banks like HDFC in India launching AI-driven voice assistants to facilitate hands-free transactions.

2. Finance:

AI in financial services is used for everything from algorithmic trading to risk management to predictive analytics. Banks, hedge funds, and investment firms leverage AI to evaluate credit risk, predict market trends, and improve customer service with virtual assistants. Financial institutions are leveraging AI algorithms to analyze transaction patterns and detect anomalies indicative of fraudulent activities. This proactive approach enhances security measures and protects both the institutions and their customers. In 2025, Citi reported that AI could increase the financial industry’s profits by 9% over the next four years, potentially pushing profits close to $2 trillion by 2029.

3. Insurance:

AI implementation in BFSI is significantly impacting the insurance sector. AI is automating claims processing, improving risk assessment, and customizing policies, as well as providing advanced fraud detection and predictive underwriting.

According to Economist Impact, 77% of bankers believe that unlocking value from AI will determine a bank’s success or failure. Tap into the growing potential of AI to transform your BFSI operations with AptaCloud’s custom AI solutions.

Consult with Us Now

Where We Fit in as an IT Powerhouse

At AptaCloud, we help companies in the BFSI sector to fully leverage artificial intelligence’s potential. We allow companies to step into AI, and most importantly, we provide the enabling technology backbone for that. Most of our customers are taking big steps in AI because they are embracing it and doing it in a way that is related to their business objectives. Armed with an in-depth knowledge of the BFSI landscape and the latest AI technologies, we alleviate the gap between innovation and execution.

We specialize in creating bespoke AI products that work well within our clients’ existing IT infrastructures. Our AI solutions enable companies to improve customer experiences, optimize processes, and increase business growth. From AI-powered chatbots to predictive analytics and comprehensive fraud detection systems, our focus is on providing innovative solutions that enable our BFSI clients to thrive in an ever-evolving digital landscape.

What’s Going on in BFSI at the Moment

Some of the Bigger Challenges from Our Clients

Navigating security challenges makes the adoption of BFSI sector AI critical in staying ahead. Some of these challenges include:

- Data Overload: The BFSI sector produces an enormous amount of inconsistent and unstructured data every day, and without proper tools to process and analyze this data, companies can’t extract meaningful insights.

- Regulatory compliance: Constantly changing regulations can make ensuring compliance challenging. With AI, compliance checks can be performed, and reporting accuracy can be improved.

- Customer Expectations: They expect incredible speed and personalization, so sophisticated AI solutions are needed to satisfy these demands.

- Cybersecurity: With financial transactions becoming increasingly digital, protecting sensitive data from cyber threats is paramount.

The Digital Transition and the Rise of AI

Organizations have embarked on a journey to transform across all facets of their business, and this shift toward digital-first is only accelerating, with AI at the centre of the journey and enabling the change. Today, financial institutions have outgrown traditional models of customer interactions and are adopting a digital approach. AI helps banks, insurance firms, and financial services companies to innovate better, customize, and deliver services at scale, and it is thus mission-critical for this shift. From more automated customer service to better risk assessment models, AI tools are being embedded across all aspects of BFSI operations, making them more efficient, secure, and customer-centric.

AI Tools We’re Leveraging

At AptaCloud, we specialize in providing AI-powered BFSI transformation solutions. These may include predictive analytics, machine learning, natural language processing (NLP), and more. Here’s a rundown of some of the most essential AI tools we’re utilizing:

1. Machine Learning and Predictive Analytics

Predictive analytics and Machine learning algorithms allow us to predict customer behavior, measure risk, and optimize operational efficiency. These tools use historical data to help our BFSI clients predict trends and information to make insights-based decisions that increase growth and minimize operational risks. For instance, in banking, predictive models can evaluate the risk of loan default based on patterns in customer behavior, and in insurance, predictive models can be used to predict the frequency of claims, thereby improving underwriting accuracy.

2. Chatbots, NLP, and Automation

Tremendously, Customer services are evolving with AI-powered chatbots and natural language processing (NLP) technologies. These tools automate low-level queries, offer real-time assistance, or even handle complex requests. For example, in insurance, NLP can be utilized to analyze policy documents and list the keywords that can help the customer make a claim and even reduce the operational workload of insurance companies. AI-driven automation is also revolutionizing back-office processes. Transactions processing, data entry, and compliance checks that used to require significant human intervention are now being automated, freeing up resources and reducing errors.

3. Emerging Tech like Generative AI

Generative AI is still a nascent technology and is just starting to find a place in BFSI. It can create realistic synthetic data, simulate financial scenarios, and help with content creation for marketing and customer communications. At such an early stage, generative AI offers tremendous potential for enabling innovation and differentiation for customers in the BFSI space.

How We’re Making an Impact

Our BFSI clientele is already reaping much value through our AI-empowered solutions. Here’s how we are making a difference:

1. Adapting Customer Experiences to Individual Preferences

In customer service, AI allows us to personalize products, services, and interactions according to specific customer needs. With the ability to analyse data points spanning each transaction the individual has made, customers’ behaviour, and even social networks, AI can provide tailored offerings that enhance customer experience and loyalty. For example, AI-enabled recommendation engines in banking can provide tailored financial products based on a customer’s purchasing patterns and life aspirations, thereby enhancing customer engagement and driving revenue.

2. Enhancing Fraud Detection and Compliance

Fraud detection is another field in which AI has a significant impact. AI can monitor extensive datasets in real time and detect unusual behavior, flagging potential fraud before it becomes an issue. AI-powered anomaly detection systems can identify suspicious transactions or behavior, enabling financial services companies to proactively protect their capital. AI tools also assist our clients in complying with industry regulations by automating reporting, auditing, and monitoring processes. This minimizes the chance of human error and helps businesses stay compliant in a world of ever-more complex regulations.

Revolutionizing Operations with AI

AI is a key driver for more efficient internal operations for BFSI organizations. AI is assisting organizations in reducing operational costs and enhancing productivity, from automating repetitive administrative activities to increasing workflow efficiency. AI-driven automation in insurance, IOP, for example, can optimize claims processing, while predictive analytics in the banking space can assist with making staffing decisions and improving service delivery.

Our Playbook for Success

At AptaCloud, we practice a well-defined methodology to make AI Integration in BFSI successful:

1. Integrating AI with Legacy Systems

Many of the BFSI institutions are still dependent on legacy systems. While implementing AI solutions alongside such systems may be part and parcel of integration, it does require specific planning and execution. With the least disruption to existing operations, we accompany our clients closely at each stage, including co-creation with innovative solutions that add edge to their existing infrastructure.

2. Building Secure, Scalable Solutions

This goes a long way because security and scalability are paramount within the sector. With advanced security measures and scalable frameworks, our AI solutions can address the increasing transaction flows and the information age.

3. Upskilling Our Teams and Clients

We believe that our internal teams and clients need access to ongoing learning for AI tools to become widespread. We train the client’s teams as AI Innovators, enabling them to understand AI’s capabilities and lead AI-enabled decisions.

Real Wins We’ve Delivered

1. Snapshot of a Banking Project

We have recently collaborated with a top-tier bank to build a bring-your-own AI fraud detection solution. Using machine learning algorithms, we assisted the bank with identifying potentially fraudulent transactions as they occurred, thereby minimizing loss and increasing client trust.

2. Breakthrough in Financial Services

We developed a predictive analytics tool for a financial services client that predicts market trends. This index-oriented tool has allowed the client to take a more strategic approach to investments, resulting in better portfolio performance and a competitive edge within an ever-changing marketplace.

3. An Insurance Game-Changer

We used an AI-powered chatbot for an insurance company to significantly improve customer interaction. The chatbot helped automate routine inquiries and processed claims, allowing for faster response times and improved customer experience.

What’s Next for Us

We continue to find new developments in the AI world as it grows and changes, with AI technology advancing at an unbelievably fast rate. We are also closely watching generative AI, explainable AI, and quantum computing; these technologies could further revolutionize the BFSI sector.

Challenges We’re Tackling

Though there is vast potential for AI in BFSI, challenges exist

1. Data Privacy

One of AI’s challenges is that to enhance it, people must confirm that their tools abide by data privacy regulations and ensure that sensitive customer information is protected.

2. Cost

AI implementation has a high cost, and businesses might find it difficult to justify the investment. Our intent is to produce easily implementable and economical solutions so that AI can scale and reach every other client.

3. Resistance to the adoption of AI

Clients may resist adopting AI because of the perceived risk of significant disruption and call prevention for just that. Resistance is not purely about technology; much is needed in education for AI value.

Let’s Keep the Momentum Going

Join us as we continue to enable our BFSI clients to leverage AI’s potential, innovate, create value, and develop robust solutions. AptCloud also focuses on building AI in every possible aspect of its business.

How You Can Get Involved

We are focused on AI-powered transformation, and as an AptaCloud team member, we will tell you how to become AI technology plugin-smart in your field and together at AptaCloud to achieve that goal. So, let’s build on this momentum and do precisely what they say we do in the BFSI space.

Conclusion

AI has emerged as a critical catalyst in transforming the BFSI sector. As we’ve seen, it is essential in improving operational efficiency, enhancing customer experiences, and mitigating risks. For banking, financial services, and insurance businesses, AI is not just a tool; it’s a strategic advantage that drives innovation and delivers measurable results. At AptaCloud, as an AI Development Company, our commitment to helping BFSI companies harness the full potential of AI ensures that they stay ahead of the curve. Through our AI implementation services, we provide tailored solutions that enable businesses to integrate AI seamlessly into their operations, improving decision-making and customer engagement. As a leading Banking App Development Company, we help banks and financial institutions enhance their digital platforms, creating secure and innovative solutions for their customers.

As we continue to explore new developments in AI, from generative AI to quantum computing, we remain dedicated to delivering solutions that shape the future of BFSI. The journey towards AI-powered transformation is just beginning, and we are excited to be at the forefront, helping our clients lead the way.